Backward reasoning

This is the 10th newsletter of Book Lovers sent on October 16, 2015, focusing backward reasoning.

This edition features Avinash K. Dixit and Barry J. Nalebuff.

Don't miss the following letters:

Last week, we’ve talk about the bandwagon effect, characterized by the probability of individual adoption increasing with respect to the proportion who have already done so.

Why does bandwagon effect matter?

Because the path we take shapes our present. And that’s particularly true for technology.

Yesterday trade-offs might not be optimal today yet are still playing a big role.

Today we will consider how to avoid being stuck with a present that was shaped by wrong choices in the past.

The main trick is to use what is called backward reasoning, which is just working backward from the goals.

Let’s take an example to illustrate what backward reasoning is: a gamble between two people. This case is also inspired by the excellent book Thinking Strategically by Avinash K. Dixit and Barry J. Nalebuff.

The Game

The rules is very simple: there are two envelopes, each containing an amount of money, the amount of money is either $5, $10, $20, $40, $80, or $160 and everybody knows this. We are told that one envelope contains exactly twice as much money as the other. The two envelopes are shuffled, and we give one envelope to Ali and one to Baba. (pun hidden)

After both the envelopes are opened (but the amounts inside are kept private), Ali and Baba are given the opportunity to switch. If both parties want to switch, we let them.

Suppose Baba opens his envelope and sees $20. He reasons as follows: Ali is equally likely to have $10 or $40. Thus my expected reward if I switch envelopes is (10 + 40)/2 = $25 > $20. For gambles this small, the risk is unimportant, so it is in my interest to switch.

By a similar argument, Ali will want to switch whether she sees $10 (since she figures that he will get either $5 or $20, which has an average of $12.50) or $40 (since she figures to get either $20 or $80, which has an average of $50).

Something is wrong here. Both parties can't be better off by switching envelopes since the amount of money to go around is not getting any bigger by switching.

What is the mistaken reasoning?

Answer: forgetting to reason backward

A switch should never occur if Ali and Baba are both rational and assume that the other is too. The flaw in the reasoning is the assumption that the other side's willingness to switch envelopes does not reveal any information. We solve the problem by looking deeper and deeper into what each side think! about the other's thought process.

Suppose that Ali opens her envelope and sees $160. In that case, she knows that she has the greater amount and hence is unwilling to participate in a trade. Since Ali won't trade when she has $160, Baba should refuse to switch envelopes when he has $80, for the only time Ali might trade with him occurs when Ali has $40, in which case Baba prefers to keep his original $80. But if Baba won't switch when he has $80, then Ali shouldn't want to trade envelopes when she has $40, since a trade will result only when Baba has $20. Now we have arrived at the case in hand. If Ali doesn't want to switch envelopes when she has $40, then there is no gain from trade when Baba finds $20 in his envelope; he doesn't want to trade his $20 for $10.

The only person who is willing to trade is someone who finds $5 in the envelope.

We say that innovative organizations need to be more horizontal.

Quick test to know wether one organization is horizontal: is anyone from the organization capable to speak publicly in the name of it? (not only authorized, but also capable of doing it without feeling overwhelmed)We often say: we are getting lost by too much connectivity. That is a mistake. The problem is not being always connected: it just increases our capacities. We are getting lost if we don't manage our attention. The key is to distinguish connectivity and attention.

a16z Podcast: A Podcast about Podcasts

Key insights:

the issue for user is managing between the attachment of one show producer (one unique style/voice/vision of the world) AND one topic of interest (eg entreprenership, sport) or mood (looking for humour, sophisticated content, entertainment, etc.)

mainstream users develop the habits of building their own selection of content (eg: netflix)

best way to market a podcast: being featured or participating in other podcasts

speaking in podcasts = performing

podcast = very intimate relationship

Forecasting Tournaments: What We Discover When We Start Scoring Accuracy

Incredible master class in superforecasting with great thinkers. Really a must watch/listen to. Two of the several lessons learned in part 1:

The correlation between your ability to tell a good explanatory story and your forecasting accuracy is rather weak

The clairvoyance test means that if the question is so well-framed that if you handed it to a genuine clairvoyant who could see perfectly into the future, the clairvoyant could look into the future, say thumbs up or thumbs down, without needing to come back to you for some ex post facto re-specification of what the question was.

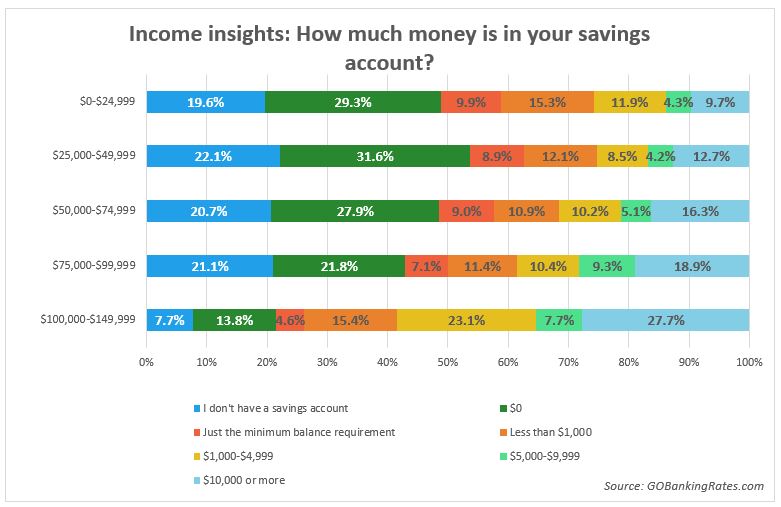

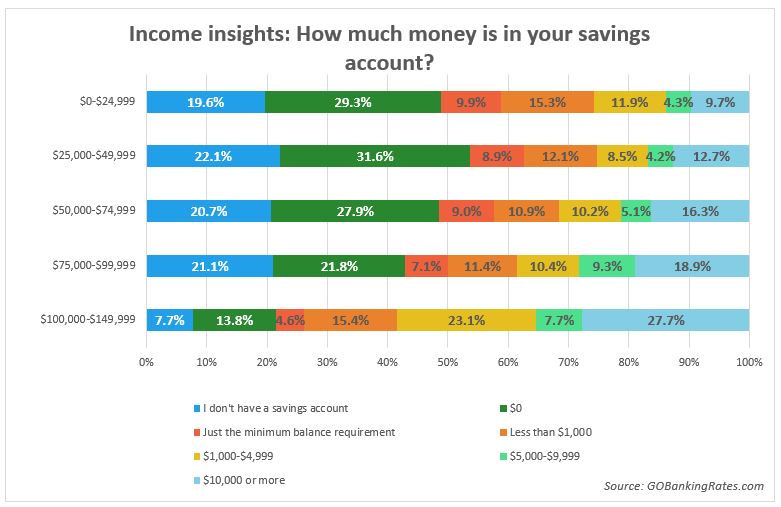

62% of Americans Have Under $1,000 in Savings, Survey Finds

I've been really surprised with the following data set. American don't save much...

(left: savings balances by age, right: savings account balances by income)